- Precisando de ajuda?

- (11) 91548-7043

- wbrand@wbrand.com.br

Closing Entries in Accounting: Everything You Need to Know +How to Post Them

The balance in Income Summary is the same figure as what is reported on Printing Plus’s Income Statement. Temporary accounts, as mentioned above, including revenues, expenses, dividends or (withdrawal) accounts. These account balances are used to record accounting activity during a specific period and do not roll over into the next year.

- The balance sheet captures a snapshot of a company’s financial position at a given point in time, and closing entries help to ensure that the balance sheet accurately reflects the company’s financial position.

- ” Could we just close out revenues and expensesdirectly into retained earnings and not have this extra temporaryaccount?

- When all accounts have been recorded, total each column and verify the columns equal each other.

- Before diving into the closing entries, double-check that all transactions are posted.

- Do you want to learn more about debit, credit entries, and how to record your journal entries properly?

We and our partners process data to provide:

This follows the rule that credits are used to record increases in owners’ equity and debits are used to record decreases. Chartered accountant Michael Brown is the founder and closing entries CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

What factors are to be considered in preparing the closing entries?

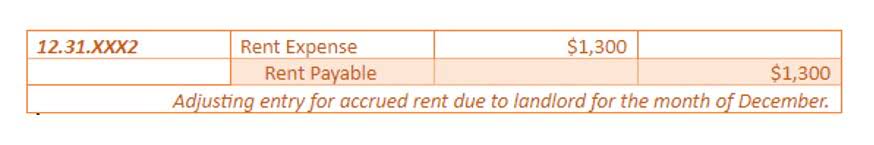

First, you close the revenue by debiting the revenue account for $100,000 and crediting the income summary for the same amount. Companies could close each income statement account to the owner’s capital immediately while making closing entries. In order to produce more timely information some businesses issue financial statements for periods shorter than a full fiscal or calendar year. Such periods are referred to as interim periods and the accounts produced as interim financial statements. Expense accounts have a debit balance, so you’ll have to credit their respective balances and debit income summary in order to close them. This time period, called the accounting period, usually reflects one fiscal year.

Step 2: Close expense accounts 🔗

In this example we will close Paul’s Guitar Shop, Inc.’s temporary accounts using the income summary account method from his financial statements in the previous example. If there is a net profit, the balance of the income summary account is also zeroed by debiting the income summary account and crediting the capital account. As the drawings account is a contra equity account and not an expense account, it is closed to the capital account and not the income summary or retained earnings account. The purpose of closing entries is to merge your accounts so you can determine your retained earnings. Retained earnings represent the amount your business owns after paying expenses and dividends for a specific time period.

Step 2: Transfer Revenue Balances to Income Summary

The eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting the entries to the ledger. Understanding the accounting cycle and preparing trial balances is a practice valued internationally. The Philippines Center for Entrepreneurship and the government of the Philippines hold regular seminars going over this cycle with small business owners. They are also transparent with their internal trial balances in several key government offices. Check out this article talking about the seminars on the accounting fixed assets cycle and this public pre-closing trial balance presented by the Philippines Department of Health. In this blog, we will discuss how to do closing entries in accounting, what is closing entries in accounting with examples, the 4 closing entries in accounting, and the purpose of closing entries in accounting.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Since the income summary account is only a transitional account, it is also acceptable to close directly to the retained earnings account and bypass the income summary account entirely.

- Close the income summary account by debiting income summary and crediting retained earnings.

- You’d never know exactly how your business performed over each period.

- Following these steps ensures that temporary accounts are properly closed, preventing carryover balances.

- Within this cycle, closing entries come after preparing financial statements and before creating a post-closing trial balance.

- A company will see its revenue and expense accounts set back to zero, but its assets and liabilities will maintain a balance.

- The net result of these activities is to move the net profit or net loss for the period into the retained earnings account, which appears in the stockholders’ equity section of the balance sheet.

- At the end of the period, their balances must be reset to zero so that the business can track income and expenses anew for the next period.

- Start by debiting each revenue account for its total balance, effectively reducing the balance to zero.

- And so, the amounts in one accounting period should be closed so that they won’t get mixed with those in the next period.

- Book a 30-minute call to see how our intelligent software can give you more insights and control over your data and reporting.

Your car, electronics, and furniture did not suddenly lose all their value, and unfortunately, you still have outstanding debt. Therefore, these accounts still have a balance in the new year, because they are not closed, and the balances are carried forward from December 31 to January 1 to start the new annual accounting period. All income statement balances are eventually shifted to retained earnings, which is a permanent account on the balance sheet.

Example 6: Closing Interest Income

This step initially closes all revenue accounts to the income summary account, which is further How to Run Payroll for Restaurants closed to the retained earnings account in step 3 below. At the end of a financial period, businesses will go through the process of detailing their revenue and expenses. Second, the closing process updates the retained earnings account to its correct end of period balance. Recall that the balance in the retained earnings comes from the statement of change in equity and not the adjusted trial balance.

Regardless of size or structure, closing entries are essential for accurate period-to-period financial reporting. While understanding the manual process provides essential accounting knowledge, modern businesses benefit significantly from automating these procedures. Solutions like Solvexia remove the tedium and risk of manual errors, allowing finance teams to focus on analysis rather than data entry. Explore how Solvexia’s automation solutions can transform your closing process and elevate your financial operations to the next level. And so, the amounts in one accounting period should be closed so that they won’t get mixed with those in the next period. Now for this step, we need to get the balance of the Income Summary account.

Impact on the Balance Sheet and Income Statement

Notice that the Income Summary account is now zero and is readyfor use in the next period. The Retained Earnings account balanceis currently a credit of $4,665. Printing Plus has a $4,665 credit balance in its Income Summaryaccount before closing, so it will debit Income Summary and creditRetained Earnings. The income statementsummarizes your income, as does income summary. If both summarizeyour income in the same period, then they must be equal.