- Precisando de ajuda?

- (11) 91548-7043

- wbrand@wbrand.com.br

2025 Toyota Tundra TRD Rally Opinion: Off-Street Fun & Well worth

Blogs

I happened to be having difficulty with a cable tv transfer from my entire life’s offers, and i is actually worried to the point of sickness that i is almost certainly not able to get it all. My better half just died and i also’ve already been worried about such finance in addition to grieving to own 8 weeks. As soon as I experienced linked to Travis, my personal inquiries have been instantaneously handled and then he lay me personally at ease.

United states and you will India close-in on the trading offer that will reduce tariffs to 15-16%

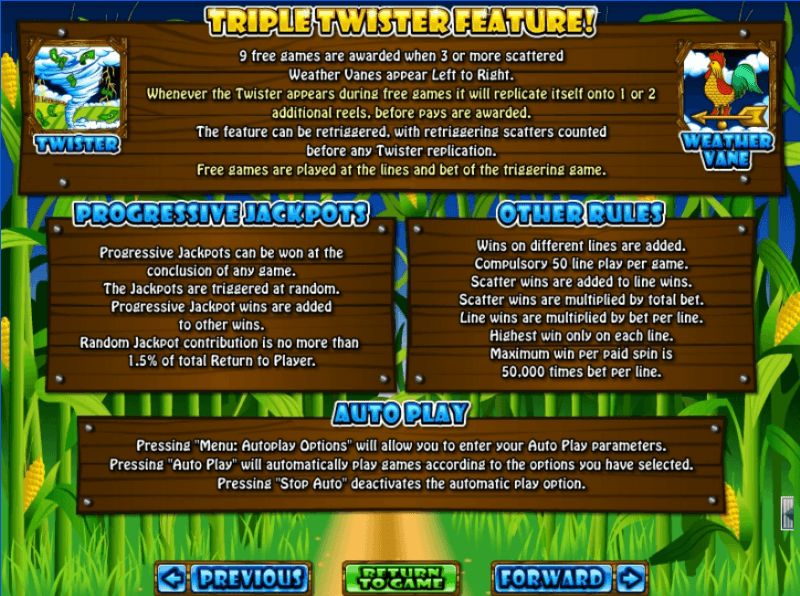

A critical downturn, although not, looks not as likely given the most recent global land unless there is a good dramatic and you can sustained building of the You.S. buck otherwise a common resolution of significant around the world concerns. Inside the a study composed for the Saturday, Goldman Sachs told you it had changed the avoid-2025 projection for Gold price so you can $step 3,a hundred of $dos,890. Gold Rally Harbors, released within the 2004, is actually a persuasive about three-reel slot machine from the Playtech having a large modern jackpot.

Legal Ruling Against Trump’s Tariffs Cause Money Volatility

Professionals say the fresh ‘safer haven’ asset is now an almost all-instances asset. Gold’s breakout over $4,000 and you may gold’s go up previous $50 aren’t speculative flukes; they’lso are verification your globe try re also-prices genuine property responding so you can monetary and you will governmental too much. Investment allotment and you will variation don’t to make certain a return otherwise cover against loss in decreasing financial segments. Treasuries, a property and pick private structure present potential. Our foundational guidance will be totally invested considering their proper allocations. The usual “hedging” hypotheses flunk away from describing silver’s extraordinary increase—as well as self-confident relationship having holds.

Gold price holiday breaks from ten years-long triangle development to your list levels

It dreadful but really sober direction is strictly exactly what investors must tune in to. The newest cost savings’s problems work on deep, and it’s from the conquering the basic problem of loans. The new national personal debt https://happy-gambler.com/incinerator/ is found on rate to help you great time because of $34 trillion, and consumer debt jumped in order to $17.29 trillion in the Q3 away from 2023. Inflation has been causing chaos, and that beckons the new Given to improve costs once again. Regions is actually dropping demand for Us treasuries, underscoring the country’s death of believe in the buck.

(Bloomberg) — A persistent increase on the cost of gold are getting windfalls round the emerging segments, boosting individual rely on inside regions you to mine and get the new steel. Silver consolidates close $cuatro,260 immediately after a historic 60% rally, however, experts alert volatility could be to come. The new lingering regulators shutdown fuels safer-refuge consult if you are Asia’s Diwali consumers move of precious jewelry to bullion even with list costs. At the same time, silver’s also provide squeeze eases since the You.S. and you may Asia shipping flow to your London places. If Government Reserve incisions interest levels otherwise signals an excellent dovish position, the possibility price of carrying gold-and-silver falls, leading them to more appealing than lowest-produce ties or cash.

In case your same development continues on, which have financial institutions looking to purchase Silver inside the dollars segments, Silver prices you may continue to be supported regarding the near term. Yet not, if your Trump government gets into an even more upbeat tone regarding the development constructive trade relationships which have Europe, Silver you are going to come under bearish tension. Silver costs steadied to your Wednesday, consolidating once Friday’s clear dos% refuse. The newest red metal got increased so you can accurate documentation most of $2,956.31 on the Friday, prompting profit-taking certainly one of traders. In spite of the pullback, business sentiment stays largely optimistic, having experts watching it while the a potential close-label modification rather than a change inside pattern.

Places circulate punctual. We disperse earliest.

Gold futures, that are deals to purchase otherwise promote gold during the a particular rates, passed the fresh threshold on the Tuesday, accompanied by the region price of silver for the Wednesday day inside the China. All in all, it’s a remarkable recovery to have a country who may have struggled in order to attention people for decades because of governmental chaos and electricity shortages one sapped economic development. Inside South Africa, the home of the country’s strongest gold mines, carries are on song to find the best year in two ages, with offers out of miners such as Sibanye Stillwater Ltd., AngloGold Ashanti Plc and Gold fields Ltd. tripling inside worth.

Keep a passionate attention to your developing geopolitical advancements plus the efficiency of your U.S. dollars, since the each other significantly dictate safer-refuge consult. The fresh golden beginning is through to us, and you may expertise their effects is vital to navigating the newest economic surroundings into the future. The new consistent, organization consult from main banking companies is expected to establish a robust speed floor, reducing gold’s historic cyclicality and you may probably mode the fresh, high equilibrium prices. Morgan Research suggesting silver you will attempt the new $cuatro,one hundred thousand for each oz draw because of the late 2025 otherwise mid-2026, the brand new metal’s upward momentum seems well-entrenched. For the short term (1-two years), gold costs are expected to look after the up trajectory.